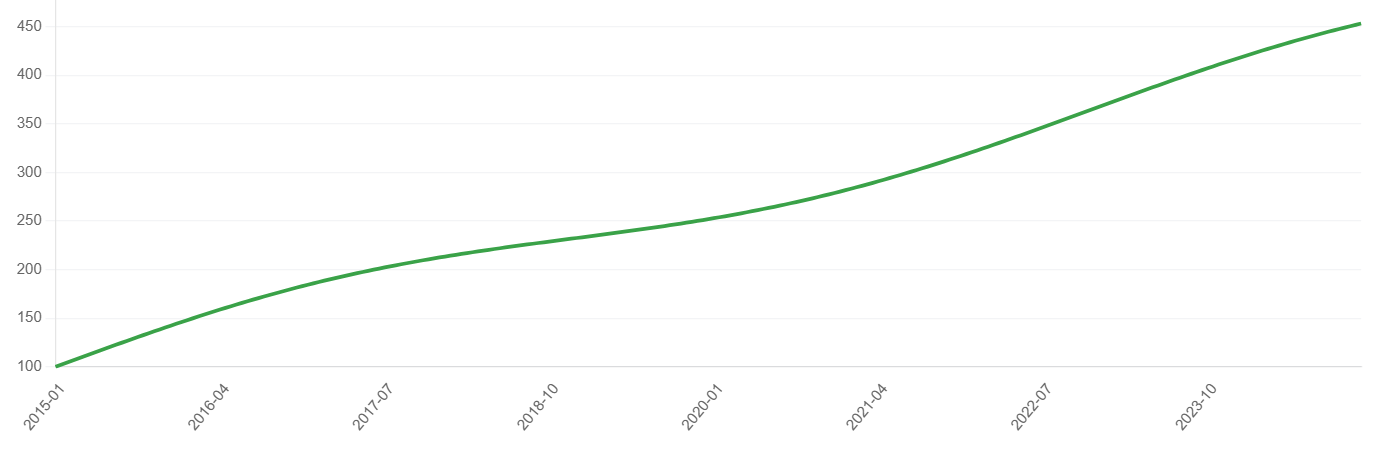

Issue #100 - Components of Time Series Data

We’ve reached Pill of the Week #100!🎉

Thank you so much for your continued support—it truly means a lot. To celebrate, I’m making this special edition free for everyone to read.

And as a token of appreciation, I’m also giving you a full week of free access to all current subscribers.

💊 Pill of the Week

In the world of data analysis, few things are as fascinating as watching patterns unfold over time. Whether you're tracking the daily heartbeat of stock prices, monitoring the seasonal patterns of retail sales, or observing gradual shifts in climate data, time series reveal some of the most compelling stories in analytics. Yet these stories often appear as confusing tangles of peaks and valleys, making it difficult to extract meaningful insights.

The secret to understanding complex patterns is not to look harder at the chaos, but to learn how to separate the signal from the noise.

The key to understanding time series lies in recognizing that what appears to be chaos is actually the result of several distinct forces working together. Just as a symphony combines different instruments to create beautiful music, every time series is the combination of four fundamental components: trend, seasonality, cyclical patterns, and random noise.

Breaking Down the Complexity

Consider a typical business scenario: you're analyzing monthly sales data for a retail company spanning several years. When you first plot this data, you see a jagged line full of ups and downs. Some months show dramatic spikes, others reveal concerning dips, and the overall pattern seems almost random.

This complexity is exactly why time series decomposition became such an essential tool in data analysis.

A time series is like a book written in a foreign language—decomposition is learning to read that language by understanding its grammar and vocabulary.

The beauty of decomposition lies in its ability to separate the signal from the noise, revealing the underlying structure that drives the patterns we observe. Instead of trying to make sense of the entire complex pattern at once, we can examine each component individually and then understand how they combine to create the final result.

The Trend: Following the Big Picture

At the heart of every time series lies its trend—the fundamental direction the data is heading over the long term. Think of trend as the underlying current in a river. While the surface may be choppy with waves and ripples, the current provides the basic direction and momentum that carries everything along.

In our retail sales example, the trend component might reveal a steady upward trajectory, indicating that despite month-to-month fluctuations, the business is fundamentally growing. This growth could stem from various factors:

Expanding market share in existing territories

Successful product launches or innovations

Improved brand recognition and customer loyalty

Favorable economic conditions in the company's sector

Strategic partnerships or acquisitions

What makes trend analysis so valuable is its ability to filter out short-term noise and reveal the true direction of change. Common approaches for extracting trend include:

Moving averages

Linear regression

Hodrick-Prescott filter

LOESS smoothing

A company might have a terrible month due to a supply chain disruption, but if the underlying trend remains positive, management can focus on the bigger picture rather than panicking over temporary setbacks.

"The trend is your friend until it's not—but understanding it gives you the power to prepare for when it changes."

Seasonality: The Rhythm of the Calendar

While trend shows us where we're going, seasonality reveals the predictable rhythms that repeat according to the calendar. These patterns are deeply embedded in human behavior and natural cycles. Think of seasonality as the heartbeat of your data—regular, predictable, and essential for understanding the rhythm of your business.

Common seasonal patterns include:

Retail businesses seeing sales surge during holiday seasons

Ice cream vendors knowing summer will bring their busiest months

Energy companies predicting when heating and cooling demands will peak

Tourism industries experiencing predictable high and low seasons

Educational institutions having clear academic year cycles

Seasonal patterns are remarkably consistent. Year after year, certain periods bring predictable increases or decreases in activity. For our retail company, December might consistently show sales spikes of 40-50% above the trend line, while January might reliably dip 20-30% below it as consumers recover from holiday spending.

For seasonal decomposition, we can use different techniques:

Classical decomposition:

Seasonal(t) = Y(t) - Trend(t) - Cyclical(t)(additive)X-13ARIMA-SEATS: Advanced seasonal adjustment used by statistical agencies

STL decomposition: Seasonal and Trend decomposition using Loess, robust to outliers

Fourier analysis

Understanding seasonality transforms business planning from guesswork into science. Companies can optimize inventory levels, plan marketing campaigns, schedule staff, and manage cash flow with confidence because they know what to expect at different times of the year.

Cyclical Patterns: The Longer Waves

Cyclical patterns represent the longer-term fluctuations that don't follow the calendar but instead reflect broader economic, social, or market forces. Unlike the regular rhythm of seasonality, cycles can be irregular in both timing and intensity—they're like ocean swells that can vary dramatically in size and frequency.

"Seasons are like clockwork; cycles are like weather—both are natural, but only one follows a schedule."

Key characteristics of cyclical patterns:

Duration: Typically last several years, not months

Irregularity: Unpredictable timing and varying intensity

Driving forces: Economic conditions, market maturity, demographic shifts

Impact: Can override seasonal and trend patterns during extreme periods

In business contexts, cyclical patterns often reflect economic conditions. During periods of economic expansion, our retail company might experience several years of accelerated growth beyond the normal trend. Conversely, during recessions, sales might remain below the trend line for extended periods, regardless of seasonal patterns.

The challenge with cyclical patterns is their unpredictability. While we can identify them in historical data, predicting when the next cycle will begin or how long it will last remains difficult. However, recognizing these patterns helps businesses prepare for inevitable fluctuations and avoid attributing cyclical changes to operational factors within their control.

Cyclical Analysis Techniques:

Spectral analysis: Using Fast Fourier Transform (FFT) to identify dominant frequencies

Hodrick-Prescott filter: Separates cyclical component from trend with smoothing parameter λ

Band-pass filters:

Cyclical(t) = Y(t) - HP_trend(t) - Seasonal(t)for specific frequency rangesWavelet analysis: Time-frequency decomposition for non-stationary cycles

Noise: The Random Reality

After accounting for trend, seasonality, and cycles, what remains is noise—the random, unpredictable variations that reflect the inherent uncertainty in real-world data. This component captures everything from one-time events and measurement errors to the countless small factors that influence our data but are too minor or irregular to model systematically.

Sources of noise in business data:

External events: Natural disasters, strikes, viral social media moments

Measurement issues: Data collection errors, system outages

Random variations: Individual customer behavior, market microfluctuations

Unmodeled factors: Minor influences too small to predict systematically

Noise might seem like the least important component, but it actually provides crucial information. In a well-decomposed time series, the noise component should look truly random—no discernible patterns, roughly consistent variance, and centered around zero. If the noise shows obvious patterns, it suggests our model missed some systematic component that could be identified and potentially predicted.

Statistical Properties of Good Residuals:

For proper decomposition, the noise component should satisfy:

Zero mean:

E[ε(t)] = 0Constant variance:

Var[ε(t)] = σ²(homoscedasticity)No autocorrelation:

Corr[ε(t), ε(t-k)] = 0for all k ≠ 0Normal distribution:

ε(t) ~ N(0, σ²)for statistical inference

Diagnostic Tests:

Ljung-Box test: H₀: residuals are independently distributed

Jarque-Bera test: Tests for normality of residuals

ARCH test: Detects heteroscedasticity in residuals

ACF/PACF plots: Visual inspection of autocorrelation structure

"Noise reminds us that the world is fundamentally unpredictable—and that's okay. The goal isn't to eliminate uncertainty, but to understand what we can and cannot predict."

📖 Book of the Week

If you're building or want to build autonomous, intelligent AI agents — whether you're a systems architect, ML engineer, or LLM tinkerer — this is one to keep on your desk:

“Building Agentic AI Systems”

By Anjanava Biswas & Wrick Talukdar

🧠 This book goes beyond chaining prompts — it’s a deep dive into designing reasoning, tool-using, self-improving agents that act with autonomy, adapt to feedback, and scale across complex tasks and environments.

What sets it apart?

It shows you how to turn GenAI from passive assistant into a capable, context-aware actor in real systems — with ethics and safety at the core:

✅ Architect agents that can reason, reflect, plan, and adapt

✅ Design tool-using, multi-step agents using coordinator–worker patterns

✅ Implement transparency, trust, and safety into decision-making flows

✅ Explore real-world use cases in finance, healthcare, and automation

✅ Master agent introspection, planning, delegation, and collaboration

This is a must-read for:

🧠 AI engineers ready to go beyond basic LLM apps

🏗️ Developers building scalable agent frameworks

🤖 Product teams working on autonomous task execution

🔍 Researchers exploring trust, safety, and AI alignment

🐍 Python-savvy professionals with a GenAI foundation

If you're ready to go beyond prompts and build agents that think, act, and evolve — this is the blueprint.

The Practical Power of Decomposition

Time series decomposition transforms how we approach data analysis and business intelligence. Instead of trying to interpret complex patterns as a whole, we can examine each component separately and understand its specific implications.

Strategic Benefits:

Trend analysis reveals whether a business is fundamentally growing or declining, independent of seasonal fluctuations

Seasonal insights enable precise operational planning and resource allocation

Cyclical awareness helps organizations prepare for longer-term fluctuations

Noise understanding sets realistic expectations for forecast accuracy

Operational Applications:

Inventory management: Stock levels can be optimized based on predictable seasonal patterns

Staff scheduling: Workforce planning becomes more precise with seasonal decomposition

Marketing timing: Campaigns can be timed to work with, not against, natural patterns

Financial planning: Cash flow management improves with predictable pattern recognition

Real-World Success Stories

The principles of time series decomposition apply across virtually every industry.

Financial analysts use decomposition to separate market trends from cyclical patterns, helping investors make better long-term decisions while preparing for inevitable market fluctuations.

Healthcare organizations apply these techniques to patient monitoring, separating concerning health trends from normal cyclical patterns and random variations. This approach improves early detection of health issues while reducing false alarms from normal physiological variations.

Technology companies use decomposition to analyze user behavior, system performance, and business metrics. By separating growth trends from seasonal usage patterns and random events, they can make more informed decisions about infrastructure investments and product development.

"The most successful businesses don't just react to patterns—they understand them well enough to work with them strategically."

Moving Beyond the Basics

Understanding time series decomposition is just the beginning of effective temporal data analysis. Once you can identify and separate these components, you can build more sophisticated models, make more accurate forecasts, and develop better strategies for dealing with uncertainty.

The key insight is that complex patterns are usually the result of simple components working together. By learning to recognize trend, seasonality, cycles, and noise in your data, you develop the analytical skills needed to extract meaningful insights from even the most complex temporal patterns.

Next Steps for Mastery:

Practice decomposing different types of time series data

Learn to identify which components are most important for your specific use case

Develop strategies for forecasting each component separately

Build systems that can automatically detect changes in patterns

Create alerts based on deviations from expected component behavior

Advanced Technical Considerations

Model Selection Criteria:

AIC/BIC: For comparing different decomposition models

Cross-validation: Time series split validation for model performance

Information criteria:

AIC = 2k - 2ln(L)where k is parameters and L is likelihood

Forecasting Each Component:

Trend: ARIMA, exponential smoothing, polynomial regression

Seasonal: Seasonal naive, seasonal ARIMA, harmonic regression

Cyclical: Spectral methods, state-space models

Combined: Holt-Winters, SARIMA, structural time series models

Time series decomposition reminds us that behind every complex dataset lies a story waiting to be told. By breaking down that story into its fundamental components, we can move from confusion to clarity, from reactive responses to proactive planning, and from guesswork to informed decision-making.

In a world increasingly driven by data, the ability to understand patterns over time isn't just useful—it's essential for anyone seeking to make sense of the forces that shape our businesses and our lives.

The next time you encounter a complex time series, remember: you're not looking at chaos, but at the beautiful interaction of trend, seasonality, cycles, and randomness. Learn to see each component clearly, and the story your data is telling will become crystal clear.

If you would like to support me please consider subscribing. Thank you.

Keep reading with a 7-day free trial

Subscribe to Machine Learning Pills to keep reading this post and get 7 days of free access to the full post archives.